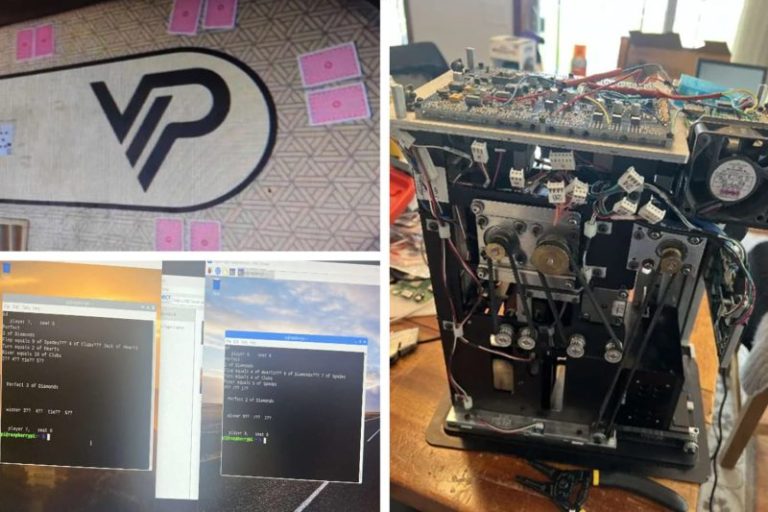

Card-reading contact lenses, X-ray poker tables, trays of poker chips that read cards, hacked shuffling machines that predict hands. The technology alleged to have been used to execute a multistate, rigged poker operation sounds like it’s straight out of Hollywood.

And those were only some of the gadgets that authorities say were used to swindle millions of dollars from unsuspecting victims through rigged, high-dollar, underground poker games over more than five years.

A sprawling indictment unsealed Thursday by the U.S. attorney for the Eastern District of New York charged Chauncey Billups, the head coach of the NBA’s Portland Trail Blazers, and Damon Jones, a former NBA player, along with members of the Mafia and dozens of other defendants, with being part of a conspiracy.

The victims were “at the mercy of concealed technology, including rigged shuffling machines and specially designed contacts lenses and sunglasses to read the backs of playing cards, which ensured that the victims would lose big,” U.S. Attorney Joseph Nocella of Brooklyn said in a statement.

Cheating at poker is as old as poker itself. But today, wearable tech and nano-cameras are putting even upstanding poker players on their guard.

The defendants used “special contact lenses or eyeglasses that could read pre-marked cards,” Nocella said at a news conference announcing the indictments.

He also showed a photo of an X-ray table that “could read cards face down on the table … because of the X-ray technology.”

“Defendants used other cheating technologies, such as poker chip tray analyzers, which is a poker chip tray that secretly reads cards using a hidden camera,” he said.

And while marking poker cards so they are visible only with special eyewear is an old trick, new radio-frequency identification and infrared technologies have ramped up the sophistication levels.

Technically speaking, many of the devices involved in the alleged scam authorities detailed Thursday are relatively cheap to manufacture, said Sal Piacente, a gaming security consultant.

By the time they reach their customers, however, the cost of industrial shufflers or tables can easily approach $100,000, once distributors and middlemen are factored in.

“You could make a lucrative career buying this stuff,” Piacente said.

Casino and gaming security consultants told NBC News that the alleged scheme was possible only because the games were underground. In backrooms, there was none of the surveillance tech that reputable casinos use to catch players cheating.

“A lot of the features which made this scheme so successful would have been ID’d a lot sooner, or very quickly, in a traditional regulated gaming environment,” said Ian Messenger, a former U.K. law enforcement officer and founder and CEO of the Association of Certified Gaming Compliance Specialists.

More than any other tech, it was the reprogramming of the industrial card shufflers — identified in charging documents as Deckmate-brand machines — that authorities said was key to the alleged game rigging.

Deckmates are not sold directly to the public — though many used ones can be found for sale online. The ones at the high-dollar games cited in the indictment could read cards and predict which player had the best hand. Neither Deckmate nor its parent company, Light & Wonder, were implicated in any way in Thursday’s indictments.

A spokesman for Light & Wonder told NBC News in a statement that the company was aware of reports about the charges against people but said they were not affiliated with the company.

“We sell and lease our automatic card shufflers and other gaming products and services only to licensed casinos and other licensed gaming establishments,” said Andy Fouché, the company’s vice president of communications. “We will cooperate in any law enforcement investigation related to this indictment.”

Reprogramming shufflers is not a new trick. In 2023, hackers at the Black Hat security conference in Las Vegas presented research showing how to hack a Deckmate shuffler and use it to cheat.

The rigged shuffler machines would transmit information about the players’ hands to an off-site “operator,” according to prosecutors.

The operator would then communicate the information to someone else at the table, dubbed the “quarterback.” The victim was known as the “fish.”

Here, the high-tech gadgets met the low-tech of a card game.

The quarterback might touch the $1,000 poker chip or tap his chin or touch his black chips to indicate who at the table had the best hand.

Text messages obtained by prosecutors also appear to show defendants concerned that a fish would leave the table if he lost too many hands.

“Guys please let him win a hand he’s in for 40k in 40 minutes he will leave if he gets no traction,” read one text message released by authorities.

But according to Messenger, the consultant, it was not the tech that made the alleged scheme so successful for so long. What set it apart was the level of communication.

For example, he said, the card information had to be seamlessly passed from the dealing machines to an off-site operator and back to a person back at the table, all without alerting the fish.

“The piece that made this so successful was the coordination, not the technology,” he said.